Contract Secured Revenue on Canto

Some potential applications and whether it can create sustainable revenues

If you enjoy this article, please consider staking your $CANTO with Four Moons. We are a leading validator in the Canto ecosystem and are helping bring awareness to the budding blockchain.

Four Moons also offer advisory services to teams building on Canto. Please reach out to us at markets@defimoon.capital to chat!

Contract Secured Revenue (CSR)

CSR is essentially a mechanism that allows a portion of Canto transaction fees from a smart contract interaction to be funneled to a non-fungible token (NFT). And yes, a single NFT can accrue CSR from multiple contract sources.

It is described well in this must read article: Introducing CIP-1 Contract Secured Revenue (CSR): Tokenized Fee Sharing for Canto Builders

The CSR NFT enables a myriad of possibilities for protocols, individuals, and the network. In this article, I do my best to give a conceptual overview of what’s possible at the application and protocol levels, and investigate whether CSR can lead to sustainable revenues. I also lay out some areas for future research, and encourage the readers to contribute!

Applications at the DApp (contract) Level

At the most basic application, CSR accrues a $CANTO treasury for the contract deployer (usually a DApp) for each transaction with the smart contract. CIP-1 will incentivize teams building on Canto to focus on product quality and to build for the long term, and should take the focus away from a vesting token for a future payday. It’s important say CSR is separate from any protocol treasury created by DApp fee structure or built-in mechanisms, but in the spirit of free public infrastructure, CSR is likely going to be the most significant contribution.

CSR doesn’t completely preclude a DApp’s native governance or utility token, but there are some good reasons and substitutes provided by the NFT. First of all, removing the token immediately reduces regulatory risk around whether it’s a security. Second, CSR enables the team to focus on building as tokens are often a major distraction.

In lieu of a native governance token, the NFT can be wrapped and fractionalized in order to be distributed to multiple parties. Tokenized CSR is yield bearing, could be airdropped/staked/traded, and also include governance rights.

CSR is valuable collateral. A DApp can leverage their NFT to get instant liquidity and make investments. For example, the Canto DEX will likely accept CSR NFTs to borrow $NOTE, and perhaps offer higher loan to value limits since the NFT is constantly accruing value. Or the loan could be self repaying from CSR fees. There are major tax advantages to borrowing against the NFT rather than selling the $CANTO yield.

Applications at the Protocol Level

CSR NFTs will lead to increased liquidity for Canto as they are easily accepted as collateral on the DEX. Each NFT is backed by $CANTO, and already acceptable form of collateral, and this will streamlines the entire due diligence process enabling fast, governance free leverage for protocols. Liquidations could be tricky, but theoretically would only happen if the $CANTO price dropped significantly and loans were in $NOTE (it’s something to think through).

Speaking of the Canto DEX, once CSR is implemented, every swap, loan, stake, and vote will accrue fees to a FPI NFT. Also, B-Harvest is tasked with building liquid staking for Canto, which is very exciting and something to look for in 2023. All of the CSR generated for the protocol could be used for ecosystem growth, gas rebates, staking incentives, etc.

How does this work?

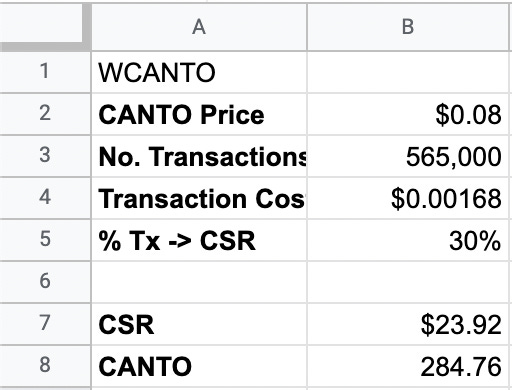

Here’s where we are at today as CSR is yet to be implemented. This is far from sustainable at the current price and is the pessimistic case.

The above math is based on the latest figures from the WCANTO contract. Assuming 30% of each contract interaction would accrue CSR, only $23.92 (284.76 $CANTO) would have been accumulated.

The Canto ecosystem is very much in the bootstrapping phase while token distribution is the primary goal before full governance goes into effect. Sustainability can occur if $CANTO price increases, transaction volume increases, or gas fees (base fee) increase. The likely outcome is all three happen with network growth.

Under the aforementioned assumptions, we can recalculate CSR. A mature network like Binance Smart Chain or Arbitrum gas fees are typically $1-2. We’ll use the more conservative $1 for now. We can also use $CANTO price at the peak of the recent rally of $0.36 (I believe it will go much higher in a bull market). I’ll also double the transactions for a higher activity network period.

Now we’re talking - over $122,000 in CSR in approximately 4 months. That’s $366,120 over the course of a year!

It’s important to reiterate different contracts can accrue CSR to a single NFT. I’m expecting different CSR collectives or DAOs to develop and work directly with new protocols to help with bootstrapping and building in exchange for CSR. For project advisors and contributors, CSR could be the way to get paid for their work. This is a system that’s well aligned as only useful contracts and applications with PMF will receive continuous use and stream fees.

Future research

Obviously, I’d love many more sets of eyes on a basic CSR model. I’m sure I smooth brained the math and am omitting some critical variables - happy to share what I’ve got.

What’s more interesting is what I alluded to in the previous section. Let’s brainstorm protocols built around CSR. Here are some additional ideas:

Chain-level governance applications. CSR could hypothetically be leveraged for additional CANTO staking.

A calculator for Fair Market Value of CSR NFTs. This is a complex model but could be interesting. The variables include, but are not limited to current CANTO accumulated, current price, predictions for future tx volume, and future price.

The above is very useful in order for tokenized CSR NFTs to be LP’d on Canto Lending, DEX, or other protocols.

🔥