Curve and DeFi Printer Go Brrrrrrrr with Convex Finance

An exciting new DApp will simplify the Curve experience and provide users with flexibility

If you want to skip the background, scroll down to the bottom bullet points to get the tl;dr on Convex Finance!

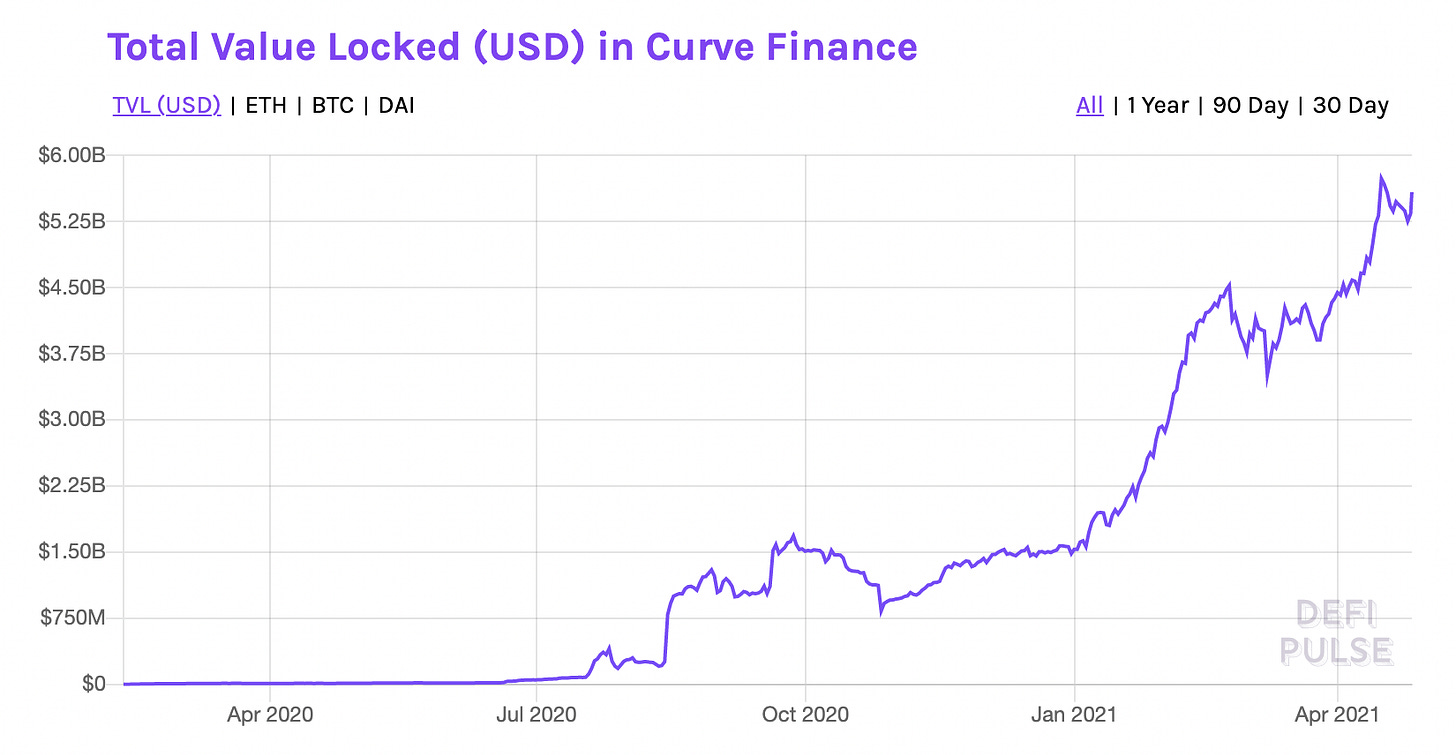

I’d argue Curve is the most important Decentralized Finance primitive in existence. Curve has grown to nearly $6b in assets in just over a year,

created its own ecosystem, has incredibly strong network effects, crossed to new chains, started scaling with Polygon (Ethereum layer 2), bootstrapped new DeFi protocols, and is now spawning new product ideas. An anonymous Curve whale in my network affectionately referred to Curve as ‘the f*ckin’ crypto money printer!’ and pointed out the international ForEx market does nearly $7t in volume each day. Curve has ambitions to become the ForEx market for cryptocurrency, and they are already laps ahead of the closest competitor. Recently, Curve did >$1b in daily volume:

and they are branching into scaling with lower fees and faster transactions on Polygon (an Ethereum Layer 2 chain):

Curve has the user interface of a 1980s computer and has many links on the top of the page, which can be confusing to a new user. Curve is intimidating and difficult to quickly grok because of the UX, and the complex tokenomics.

Calculating how much you can potentially earn on your stablecoins, bitcoin, or ETH, and how much to CRV buy to maximize your yield is no easy task. To fully take advantage of this explosive protocol you must understand the CRV token. Essentially, the CRV token is used for several things, listed below, and the longer one locks CRV the more powerful it becomes:

CRV emissions to incentivize liquidity

Vested CRV (veCRV) is locked CRV for voting rights

veCRV gets a share of protocol fees

veCRV boosts yields for liquidity providers (deposits)

Convex Finance (Medium link) is a DApp designed to simplify the Curve experience and provide maximum boost for any of Curve’s pools. Convex makes the highest possible returns far less expensive and the process of configuring a profitable setup much easier than using Curve directly.

A common question the Convex team has been answering is the difference between their new protocol and yearn, which also has a massive stash of locked CRV (veCRV). yearn’s stablecoin strategies automatically sell earned CRV at maximum boost and deposit back to the deposited token (e.g. deposit DAI, earn DAI by selling CRV). The yearn DAI vault utilizes yearn’s huge CRV stash and maximum veCRV boost to farm give the highest possible returns. yearn takes a 2% fee for each deposit in their v2 vaults.

An answer from a team member in the discord is below:

The biggest difference with Convex is they will return CRV tokens, which the depositor can either sell, save, lend, or stake! The flexibility of doing whatever you want with the earned CRV is a great differentiator. Not to mention additional yield from the curve protocol fees and CVX governance tokens, which are going to bootstrap liquidity. And the icing on the cake is there are zero fees for depositors or withdrawals.

A very generous airdrop for veCRV holders is expected. If you don’t have any veCRV, unfortunately you’re too late because the snapshot has already been taken.

The Curve DAO vote to whitelist transactions from Convex Finance is passing unanimously, so Convex will be launching in the next few weeks. Liquidity mining and yield farming opportunities will include stablecoin deposits and providing liquidity for CVX pairs.

What will Convex do for the DeFi ecosystem?

Add to Curve’s dominance as the go to no-IL swap (stablecoins, ETH, and BTC)

Increase Curve’s Total Value Locked by easily onboarding more liquidity at lower fees

Incentivize saving for smaller stakers who cannot afford locking up significant amounts of CRV

Wake up more people to the power of veCRV who have already received a windfall from Binance Smart Chain’s Ellipsis protocol, and now the CVX airdrop

Not investment advice, but will likely lead to an explosive increase in the price of CRV

Higher CRV price means higher yields across the entire DeFi space

Higher DeFi yields increases the amount of capital flowing into the ecosystem

More capital in the ecosystem means continued price appreciation for ETH and DeFi tokens