Hits and Misses on 2022 Blockchain Bold Predictions

Full transparency because that's what we're all about on the chain

Let’s check the scoreboard, but first here’s the link to the original post on my 2022 bold predictions.

Big Misses:

UST exploded to $18b supply, but collapsed in spectacular fashion when it lost the dollar peg and $LUNA crashed to zero. This was a painful experience for many (including myself) as the bear market reached a fever pitch in May.

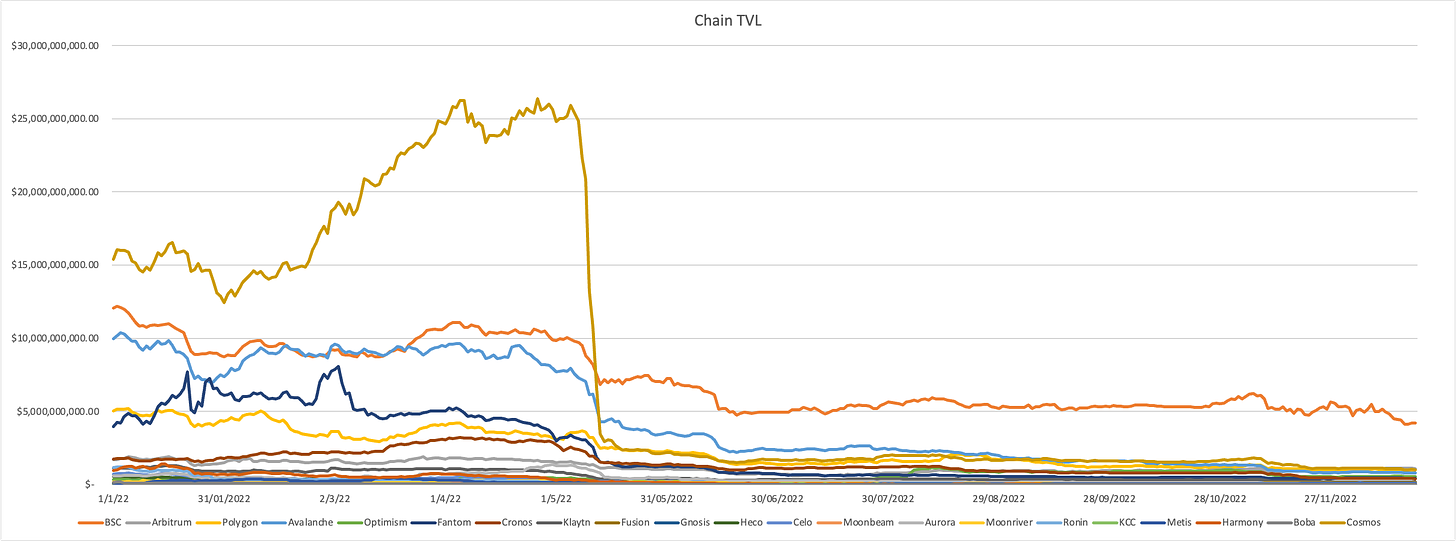

DeFi TVL dropped precipitously through 2022 due to depressed crypto prices, stablecoin fears, and regulatory fears. We are currently around $50b so I missed this badly.

Cosmos (light brown at the top) got off to a ferocious start thanks to the growth of Terra, but the UST depeg and LUNA collapse lead to terrible contagion across growing ecosystems like Osmosis.

Not yet! Satoshi or Vitalik still the top candidates IMO.

$COIN outperform $JPM. BIG OOF.

This was very wrong, but not because of on-chain analytics, moreso due to the lack of transparency, risks taken by CEX crypto lenders, fund blowups, and fraud.

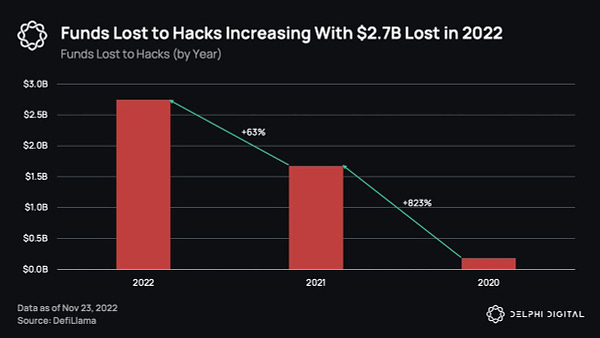

WAY more exploits in 2022.

Big Hits:

The Merge was originally planned for June, but succeeded in September!

Bitcoin Dominance - I’m going to call this a hit because in previous bear markets the chart has been up only. This cycle, it’s been flat due to value accrual on smart contract chains and real yield on DApps

DeFi on Bitcoin has been a complete flop.

Saylor and Bukele bought more bitcoin through the never ending dips, and don’t plan on slowing down.

I got the multichain world and $OP token right, but we’re waiting on the Arbitrum token still…

Growth of Synapse, Layer Zero, bridge aggregators like Bungee/Socket all have enabled the crosschain thesis to play out.

And unfortunately there were multiple 9 Figure Exploits. Ronin, Nomad, Binance Smart Chain, eg.

Here’s the chart for Sandbox, arguably the best performing Metaverse token in 2021:

Undercollateralized lending did quite well in terms of growth and adoption (Maple, DAMM Finance, Clearpool), however, it was not immune to the contagion from FTX’s blowup.

Pretty, pretty, pretty good, but meh:

Staked ETH derivatives grew in terms of ETH, but fell in terms of USD due to the fall in crypto prices. $8.3b in ETH is staked (6.9m ETH).

Some stuff is starting to happen in NFTFi, but there is a lot more to come. NFT Lending launched in 2022, but there are lots of risks/mechanisms that need to be figured out around liquidations, LTV, and how to incorporate new collections. NFT Marketplaces certainly have gotten competitive and much better - The Blur launch was a smash hit.

No stablecoins for FAANG yet, but Visa announced they are looking to incorporate payments in stablecoins directly from users’ wallets. Also, Elon Musk acquiring Twitter certainly opens the door for some tokenization/decentralization/payments.

In summary, I’ll give myself a C+ only because I didn’t see the Bear market coming as ferociously as it has played out.

Time to write my 2023 predictions thread!