Leveraged Boosties - Lend Flare and Curvance

Ethereum's newest money markets allow borrowers to leverage Curve LP tokens while generating yield from Convex

I am bullish everything stablecoins, as are most long term crypto and DeFi believers. Stable crypto assets like USDC, DAI, FRAX, and UST carry little to no price volatility risk, and are the gateway to mainstream adoption for payments, which creates enormous efficiencies across every industry. Governments and regulatory bodies are being cautious with their approach to stablecoins, and aren’t eager to give them the green light because it leads to a loss of control.

Curve is the epicenter of everything stablecoins. Curve launched during the Ethereum DeFi explosion of 2019-20, is a low fee multi-chain decentralized exchange, and one of the primary sources of yield in DeFi. I’ve affectionately called Curve the epicenter of DeFi before because I believe it’s responsible for the billions of liquidity that have flowed in.

Convex supercharged Curve through the power of crowd sourced vote escrowed CRV (veCRV). They offered big incentives for CRV holders to lock their tokens forever, which has made the Convex protocol the largest holder of veCRV. The result is they can provide Curve depositors users with the maximum yield (boosted CRV - boosties) in exchange for a small fee.

There is currently $20.5b TVL on Curve across all chains, and that number continues to surge with the addition of Factory/v2 pools where volatile assets can be swapped.

Over half of that $20.5b TVL is using Convex to maximize CRV emissions and yield boosts.

Convex is one of two DApps I use consistently on Ethereum mainnet and it’s a yield machine - both through boosted CRV/CVX rewards and vote locked CVX bribes. I love Convex, and will happily give myself clout for writing about it numerous times ahead of it’s incredible growth trajectory.

Money Markets are the logical evolution for Curve and Convex

There is a tremendous amount of liquidity, both stable and volatile, that is underutilized as collateral in DeFi. We love capital efficiency DeFi, so a couple of protocols have seized the opportunity to build in a way to get liquidity from yield bearing LP tokens.

It’s about time we got more leverage, amirite?

Two emerging Ethereum money markets, Lend Flare and Curvance, will allow Curve depositors to get leverage, and create yield opportunities for liquidity providers.

Lend Flare

Lend Flare is an Ethereum protocol that offers fixed term loans on capital that is LP’d in Curve. Lend Flare takes the Curve LP as collateral, deposits it into Convex so the borrower continues to earn CVX and CRV at the maximum rate while they are borrowing.

The borrowed capital is originated via Compound Finance. How does Lend Flare get capital from Compound with Curve LP as collateral you ask? They don’t…this is where LP’s come in.

Liquidity Providers aren’t providing capital for loans directly, they are providing collateral for loans through Compound. Lend Flare manages the Compound loans on behalf of collateral providers (LPs). LPs receive 50% of the interest from Lend Flare loans, the $COMP tokens, and $LFT.

The loans are 3, 6, or 12 month fixed terms and interest is due in full regardless of whether the borrower repays ahead of time.

IDO 💲

Lend Flare has opted for protocol owned liquidity, where 15% of the supply is being sold for ETH to determine the initial price of LFT. As of writing, only $350k has been raised, which would make the initial price $0.00076941 (fully diluted market cap of $2.33m).

Safety 🔐

Lend Flare has been audited by Certik, and there’s a Multisig and timelock on the contracts. There really isn’t a way for the devs to steal funds, but there’s always a chance for a smart contract bug (standard disclaimer). This seems relatively low risk as it depends on battle tested protocols (Compound, Curve, and Convex).

Tokenomics 🪙

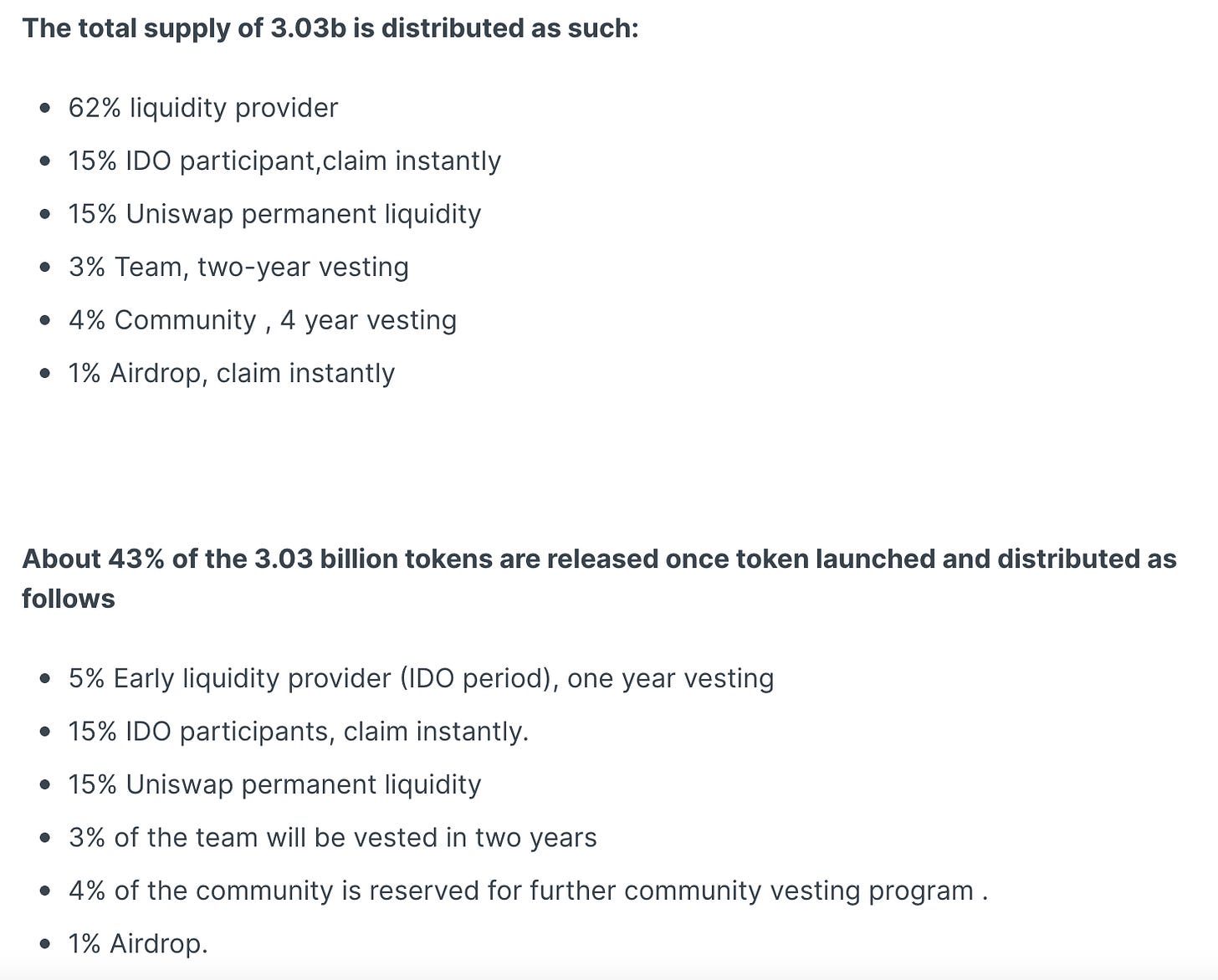

Nothing seems out of the ordinary here, however, Lend Flare has opted out of rewarding borrowers. That is something I’d recommend changing because liquidity providers are unlikely to hold LFT rewards should borrowers not arrive.

The LFT token can be vote escrowed to veLFT for 1, 2, 3, or 4 years in order to receive protocol fees (interest from borrowers) and additional LFT rewards boosts from providing liquidity.

Airdrop! 🪂

vlCVX and veCRV holders will share 1% of the $LFT supply. The airdrop is proportional to each users’ amount of veCRV and vlCVX.

Long Term Vision 📉

It’s nice to see a protocol offering leverage on Curve LP tokens, and the mechanism for getting the loans is novel. However, paying for liquidity is not sustainable, and this type of protocol can easily be brushed aside by Compound or Aave as soon as they offer lower interest loans against CRV or CVX LP tokens. I also think the governance/transition to a DAO needs more clarification. For now, it appears like a great way to get some leverage and farm LFT!

More Info: ❓

Website: https://lendflare.finance/

Twitter: https://twitter.com/LendFlareOffic

Curvance

Curvance is a venture backed Ethereum DApp that has been slower to market than Lend Flare. It is a very similar concept to Lend Flare, however, rather than using Compound capital for loans, Curvance uses Rari Fuse Pools. What’s interesting about Rari Fuse is it’s possible Curvance could move to a Layer 2 at some point since Fuse is live on Arbitrum. This could be a significant advantage over Lend Flare due to a reduction in Ethereum transaction fees.

4% platform fees are charged to borrowers. The fees are deducted from the yield generated by the borrowers’ collateral on Convex. These fees are distributed to veCVE holders (CVE stakers) and 0.3% tax is withheld by the Curvance treasury. While the fees are slightly higher than Lend Flare, Curvance is aggressively pursuing value capture from the start.

Bonding 💲

Curvance may raise additional capital in exchange for CVE through the bonding of certain assets. It’s very likely the accept similar assets to Redacted (CVX, cvxCRV, CRV) should they go this route. Curvance has hinted at bribes for token lockers, so it’s quite obvious they will be looking to acquire CVX.

Safety 🔐

Curvance is building out the front and back end, and an audit is slated upon completion of the code

Tokenomics 🪙

I would have loved to participate in their seed round, and I assume a lot of Curve/Convex OG’s were banging down the door too.

There are a lot of exciting and useful features baked into the token and protocol management. There are two versions of locked CVE (veCVE and cveCVE). The former is locked for a year, gives governance rights to the holder and is non-transferrable. The latter is a liquid version of locked CVE (similar to cvxCRV), but voting rights are delegated to the DAO. Both locked token holders early protocol fees and bribes. Voting rights are crucial because they direct CVE liquidity incentives to the many different liquidity pools, and to help decide which assets can be added for bonding.

Liquidity providers will receive vested CVE over time in order to keep APRs high enough for the protocol to remain liquid enough to satisfy borrower demand

The team and investors have a sizable portion of the token supply. Team tokens vest monthly over 2 years, and seed investor tokens are veCVE, meaning they will receive governance and fees from the start. There is no cliff for the team so there’s nothing from stopping selling after the first month.

Airdrop! 🪂

Social media airdrop (tiny), and LPs on Curve, Convex, Yearn, Badger, and Frax will share 2.18% of the $CVE supply

Long Term Vision 📉

I’m fairly bullish on this project should they catch up with Lend Flare’s development progress. The money raised should provide broad exposure and FOMO into trying the protocol or buying the token, and the integration with Rari Fuse is certainly more flexible than Compound over the long term. Early unlocks, and 1-year unlocks are bogeys to watch out for if you plan on buying CVE. I also would like to see the protocol incentivize borrowing to build demand and create high interest opportunities for lenders.

More Info: ❓

Website: https://www.curvance.com/

Twitter: https://twitter.com/Curvance

How to play it?

I will be LP’ing in Lend Flare to farm LFT. I don’t see a long term sustainable competitive advantage or anything that couldn’t be easily integrated by Aave, so it seems like one to sell for yield.

Once Curvance launches, I will shift my focus there. I get pretty good vibes, similar to how I felt about Convex before it launched. The CVX token was very volatile early on due to airdrop claims/dumps and illiquidity. It’s likely CVE follows this trend over the first week or so too. The major difference is CVE won’t be easily farmed/dumped due to the vesting requirement for LPs. It will be very difficult to vampire farm Curvance and sell pressure should be quite low…

Anyways, DYOR. Have fun getting leverage on your Curve stablecoin liquidity while collecting those juicy boosties thanks to Convex!

Ethropy Referral Links

Osmosis Validator for Four Moons - Delegate $OSMO

Voyager Referral - Get $25 in $BTC

Ethropy Wallet - ethropy.eth

Buy a Ledger Hardware Wallet (Affiliate Link)