Introduction and Background

The image of the strongest man in biblical times holding up two massive pillars encapsulates how the latest hot decentralized exchanges works for liquidity providers, traders, and token lockers. Everything is balanced and held up by the protocol design.

Moreover, “Solidly” gives us all 2022 PTSD after Andre Cronje’s ve(3,3,) Fantom experiment went poorly. He hard coded a non-upgradable contract with a significant emissions mistake (they were drastically too high), forced us to interact with a horrendous website, and composable protocols like Solidex launched disastrously, costing many veNFT communities precious rewards. I’m looking at you veDAO ($WEVE holders). The $SOLID token is also down 99.74% as it was trading between $8-20 in Feb. 2020 and is now $0.039.

Velodrome has masterfully rewritten and redeployed the contracts, which are now the standard for the forked DEX designs across Arbitrum, Polygon, BSC, and Ethereum. More are launching every day and Uni-v2 seems to be a thing of the past.

A Perfect Balance

The ve(3,3) model satisfies partner protocols, liquidity providers, and utility token lockers (except those of course who are unfamiliar with providing liquidity and impermanent loss). The veNFTs held by team members also ensures long term alignment with investors and partners.

Let’s identify the major players:

Liquidity Providers (LPs) - Velodrome’s audited contracts and the original Solidly AMM stable/variable pools make it a safe and easy process to add liquidity. LPs are compensated with native protocol emissions (token) that vary based on the number of votes the given pool receives by veNFT holders (token lockers). LPs do not receive swap fees in the ve(3,3) DEX, so a sharp criticism of the design is that liquidity will eventually migrate to a higher APR later on.

Lockers/veNFT holders - veNFT holders receive rights to vote on where emissions are directed each epoch (weekly). Protocols and individuals have the ability to ‘bribe’ voters by trustlessly depositing tokens into a contract that are evenly split based on veNFT voting weight. Bribe APRs have been very good and are averaging >100% APR across the major DEXs like Velodrome, Thena, and Equalizer. This is the largest benefit to holding veNFT and voting each epoch since swap fees are not nearly as significant in a bear market.

veNFT holders also have a claim to fees from the pools they vote for. Longer lock times receive higher voting weight, and thus a larger share of bribes and fees. The biggest criticism of the veNFT model is the lack of liquidity or fair value calculations in order to allow holders to exit. The existing solution usually comes via selling either OTC or through a NFT marketplace at a discount to spot price of the emissions token.

Traders - The combination of secure liquidity pools that receive emissions and veNFT holders that receive swap fees creates deep liquidity and higher swap volumes. Traders are often routed through ve(3,3) pools due to deep liquidity. Velodrome frequently competes with Curve and Uniswap on Optimism, and Thena controls the longer tail stablecoin flows on Binance Smart Chain.

DEX aggregators have incorporated ve(3,3) DEXs and this will be the primary way traders buy and sell tokens over time.

Protocol Founders - The protocol’s primary responsibilities are:

1) Innovate on the original Solidly design.

The original Solidly design includes a ‘rebase’ each epoch flip that increases the veNFT holders’ size to prevent dilution. This benefits early lockers, however, in a free market anyone can buy and lock a veNFT, oftentimes at a far lower price depending on market conditions.

Thena raised funds for the protocol via the sales of artistic theNFTs that recieve 10% of all protocol swap fees when staked. They also enabled veNFT splitting and merging, and a referral program. Finally, they have delayed bribes/fees by one epoch in order to prevent short term token pumping.

Equalizer, on Fantom, is the first ve(3,3) DEX to remove rebasing. This is an interesting concept because it requires veNFT holders to lock their emissions or constantly buy to retain their share of bribes/fees.

2) Business Development

A strong focus on business development efforts can be a differentiator for ve(3,3) DEXs. The ve(3,3) DEX positions itself as a protocol for protocols, where long tail assets can drive liquidity to their token pairs via bribes or providing their own liquidity. Oftentimes, protocols are also given a veNFT, which enables them to vote for their own pool and receive swap fees.

ve(3,3) DEXs are a marketing engine for new or undiscovered projects. Partnerships often lead to higher awareness, increased token price, and another revenue stream when teams earn and utilize veNFTs. One recent example is Tangible DAO, a tokenized real estate and real world asset protocol that has its own stablecoin, USDR, currently listed on Velodrome and Thena.

3) Voting

Each protocol has allocated themselves a portion of the token supply and locked them up for a minimum of 2 years. This creates aligned long term incentives for the team and investors. Typically, the team will vote for their own liquidity pool in order to properly incentivize LPs because maintaining liquidity for a ve(3,3) token is a delicate balance. LPs like to sell emissions to counteract impermanent loss or earn yield, and veNFT holders like to compound the token into their position.

4) Building new features and products

Velodrome’s v2 is currently in audit and has many new features. Thena has teased concentrated liquidity on Twitter, and Satin is launching next month, which has many new components (LP token locking to deepen $SATIN/$CASH liquidity, a 4Pool, autobribes and $CASH rebases).

The Future of ve(3,3) DEXs

The biggest mystery about ve(3,3) DEXs in the medium term is how they will perform in a crypto bull market. Swap volumes and new money have been meager, at best, yet $VELO, $EQUAL, $THE, and others have returned multiples since they launched.

I predict these tokens will be massively reflexive once new money flows back into crypto. Volumes and swap fees will increase, bribe amounts will increase, thus leading to more utility token lockers (veNFTs) in order to earn their share. As locks exceed emissions, APRs for liquidity provider increase, thus leading to a flywheel effect that brings in greater TVL. This is reflexivity in motion, and we love to see it.

Even with higher TVL, liquidity incentives slow down asymptotically and APRs drop for LPs. It’s very likely a large share of liquidity leaves since LPs don’t receive any swap fees. It’s difficult to built moats in the hyper-competitive world of open and permissionless finance. One solution is to provide veNFTs to partners in order for them to keep protocol owned liquidity (POl) on the ve(3,3) DEX and earn their share of swap fees.

I also expect DeFi composability will be built around ve(3,3) LP tokens and veNFTs.

Guru Network is “black holing” $THE to earn fees and bribes. ve(3,3) LPs can deposit LP tokens and they lock it as $veTHE, then share fees and bribes with LPs. Lockers get a liquid token wrapper ($eTHENA) and can cash out in exchange for a portion of fees/bribes.

veNFT AMMs (veNAMM) will mature and become more liquid thus enabling veNFT holders to exit efficiently and for various collaterals

Once liquidations are solved for veNFTs, lending could be a significant way to unlock more capital efficiency. E.g. loans (self repaying)

The biggest moat any of the ve(3,3) DEXs can achieve is integration with a major CEX. Velodrome is the best positioned with the announcement of Base, Coinbase’s optimistic rollup chain. Velodrome has a close knit relationship with the Optimism team and are in the driver’s seat to deploy on Base when it’s ready. The more battle tested, secure, and audited a protocol is helps get priority for compliant and accessible front ends that will onboard the next billion users. This is the way for ve(3,3) DEXs to receive consistent order flow and return value to veNFT holders for the long term.

My Portfolio Strategy

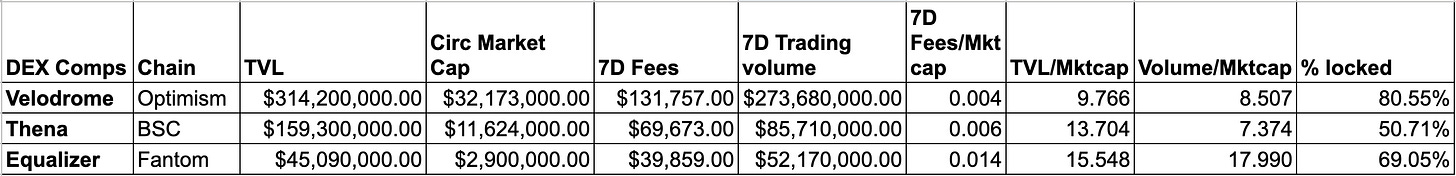

Below is a rough example of how I comp ve(3,3) DEXs, but there is a huge amount of nuance that is excluded from these data (emissions, rebases, composability, new features, partnerships and endorsements, age, etc etc). What I assume will happen is every one of the ve(3,3) DEXs with reputable and trustworthy teams will continue to suck in TVL and take a larger share of swap volume, which should lead to token value accrual as more users acquire veNFTs.

Velodrome and Equalizer are excellent protocols and have strong builders, advisors, and communities.

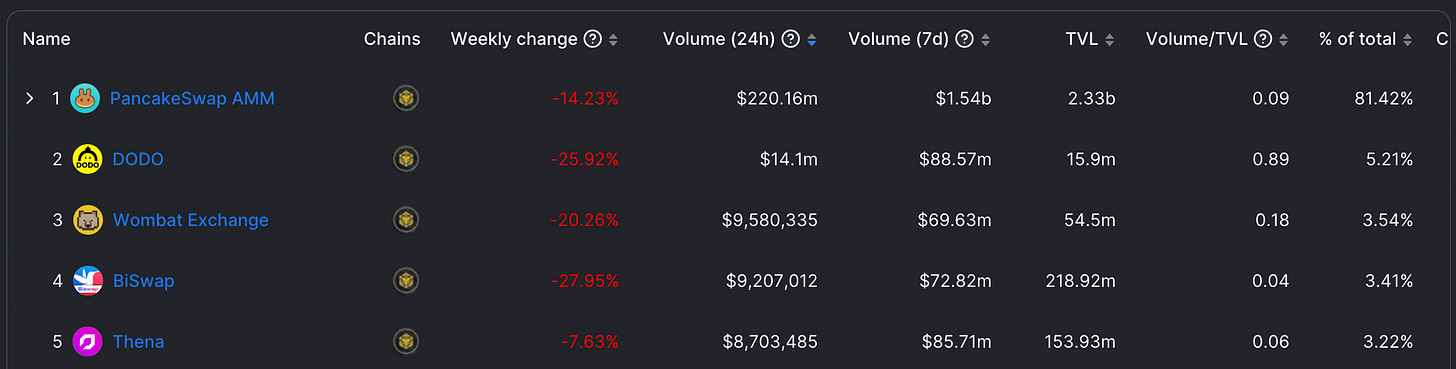

I have made a significant portfolio allocation to $THE and $veTHE (Thena) because of their excellently orchestrated launch, the rollout of a flawless and beautiful product UX, the team’s attentiveness the community and DeFi ecosystem, and the enormous upside for TVL and volume on BSC. Their early success has not required any private/VC investments or any veTHE lock incentives. Within the first couple of months, Thena has achieved 5-10% of Pancakeswap’s weekly volume.

Recently, it was revealed the team is DOXXed and part of the extremely experienced Fantom builder ecosystem. They have discussed plans for building concentrated liquidity, metastable pools, and boosted pools on Thena in the future.

Finally, the biggest catalyst for $THE price would be an official endorsement from Binance. My infamous quote tweet from CZ (CEO of Binance) is proof they are paying attention to BSC DeFi!

Some lesser known DEXs also provide interesting prospects for yield.

Velocimeter on Canto - A nice yield farm with very high APRs due to front loaded emissions and low TVL. Cosmos assets will begin to migrate over from Osmosis due to better capital efficiency than they can earn across the IBC ecosystem. The team is working to list veNFTs on Alto Market in order to raise liquidity for the protocol. Stay tuned if you’re bullish Canto and believe the team can execute to bring in protocols and bribes from the Cosmos ecsystem and Canto long tail assets. The potential is massive for this ve(3,3) DEX!

Satin on Polygon - Satin solves a very important problem for early ve(3,3) DEXs; liquidity constraints for the native token. The achieve this by locking the SATIN/CASH LP token rather than just SATIN for veSATIN NFTs. There will be very thick early SATIN liquidity due to a ginormous presale that was oversubscribed many times over. Presale investors have a 12 week vest, which actually gives an advantage to secondary market buyers who can buy and exit earlier.

Solidly DEX on Ethereum - this is one I will not interact with nor look into due to the reputation of the team. It has amassed a large TVL, but is composed of majority stablecoin farmers.

Sterling and Slizard have launched on Arbitrum and are offering attractive yield, but are early and the teams are less established. Arbitrum is very crowded with upstart DEXs, Uniswap, Trader Joe, and GMX so standing out is difficult.

Ramses and USDFI (I’m pretty interested in this) are ones to watch.

If you enjoyed my article, please consider using my Thena Referral code:

www.thena.fi/referral/?ref=acedabook

Support Ethropy!

Canto validator for Four Moons - delegate $CANTO

Ethropy Wallet - ethropy.eth

Buy a Ledger Hardware Wallet (Affiliate Link)

TradingView Referral - Get $30 off annual Subscription

None of this is financial advice