$veTHE is $the Trade

Thena Offers a Variable Lifetime Annuity

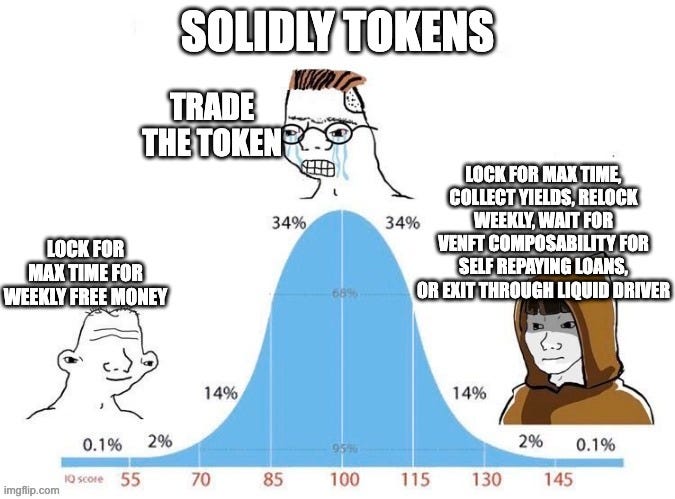

Don’t trade $the, the native token for Thena Finance, an adaptation and innovation of the original Solidly DEX. It’s illiquid, it’s a farm and dump token, it’s a haven for mercenary capital as emissions start high and then TVL/volume will evaporate over time. Don’t look at the chart and try to do technical analysis. Don’t listen to crypto influencers on Twitter who tell you it’s going to the moon. All of that is noise. There is over a year of data to show us buying native Solidly DEX tokens is a recipe for disappointment, especially in a bear market.

Sadly, it’s true for nearly every decentralized exchange that’s ever launched a token and built TVL through incentives (liquidity mining). Liquidity inevitably migrates away from the DEX as incentives (yields) decrease, and it’s exacerbated when macro liquidity shrinks.

In this article, I’m going to explain to you how and why locking Thena’s native $the token (for $veTHE) is an exception and will provide outsized passive income with additional composability. This is not an article to shill a narrative or technical trade as I believe Solidly tokens were not designed to trade unless you’re a LP selling yield. It’s difficult to pigeon hole this into a traditional investment vehicle, but I view it as a variable lifetime annuity, where the yield and underlying value grow with the protocol.

Lock it for $veTHE, don’t trade it

I’ll repeat, don’t trade $the! Instead, you can provide liquidity on Thena’s DEX to earn your $the bags, which should then be locked for the maximum time, two years. Thena’s liquid emissions are approximately 1.3m $the this week (30% of tokens go to $veTHE holders as a rebase), and will decay at 1% per week forever. You have plenty of time to collect your $the tokens, and no, you don’t have to buy it. Currently, over 60% of newly minted $the are being locked by existing liquidity providers.

Thena is a highly capital efficient DEX and provides the best trade execution for many assets in all of Binance Smart Chain. You can then max lock (2 years) your $the rewards for $veTHE, the most versatile and innovative NFTfi primitive born in the bear market. $veTHE is simply the right to vote for which pools $the emissions go, and in return you’re entitled to your share of bribes and swap fees from said pools.

$veTHE is a decentralized finance vehicle analogous to a variable annuity combined with equity in the protocol. $veTHE provides weekly yield and the underlying value can appreciate as the protocol revenues grow. The NFT is transferable, can be fractionalized, loaned, or ‘liquidated’ before its maturity. Each epoch, $veTHE holders decide how to allocate their voting power in return for fees and bribes that are averaging 100% APR (1.9% PER WEEK), plus a 30% of each week’s emissions are added to each NFT (rebase) to prevent dilution.

Let’s see what this looks like after 7 months of being live on Binance Smart Chain. Thena Scribe, the best account to follow for Thena information, calculated a $10k of $veTHE would have returned 2x in yield and another multiple in $veTHE rebases. The underlying capital could be redeemed through Liquid Driver’s $liveTHE, which is explained below, but the total return is over 300% (466% APR).

But Adam, you said ‘don’t trade $the!’ I did indeed, and of course I would never give out financial advice. I am also being facetious because I truly believe $the tokenomics are so unique that trading it like a speculative asset is futile. Now, what catalysts do I believe are present in order to sustain $veTHE returns over the long haul?

How will Thena avoid the dreaded Solidly negative flywheel?

In the near term, Thena must generate enough revenues to offset $the emissions paid to liquidity providers in order to encourage a high lock rate. $veTHE will be considered a wildly successful investment if it holds its underlying value while returning significant yield (~100% APR) from swap fees, bribes, and autobribes. Assuming $veTHE holds its value, it’s one of the best risk adjusted bets in all of DeFi.

There will be a fluctuating equilibrium between liquidity providers (happy with good yield either from $the emissions or fees generated by $veTHE), $veTHE investors, and protocols who are bribing in order to deepen liquidity for Thena DEX pools. When fees go up, more locks occur in order for investors to realize the yield (buy and lock pressure on $the). When yields become too diluted, lockers can sell their locked positions via converting $veTHE NFTs to $liveTHE on Liquid Driver or selling their NFT on a secondary marketplace. In other words, this yield dilution will likely lead to sell pressure on $the. There should be this natural oscillation in price as the token finds equilibrium. However growth, true growth, can and should be measured by fees generated by the DEX, bribes from partner protocols, ALPHA perps, and other revenue streams.

As mentioned, $the emissions decrease at a rate of 1% per week, which means LPs have to make a choice between moving their capital to a new DEX to farm yield, or staying on Thena and locking $the for $veTHE to collect swap fees, bribes, and other revenues. The latter choice is what many partner protocols are doing as they believe their protocol owned liquidity will generate meaningful fees and allow investors to trade their token as DeFi grows over the coming months and years.

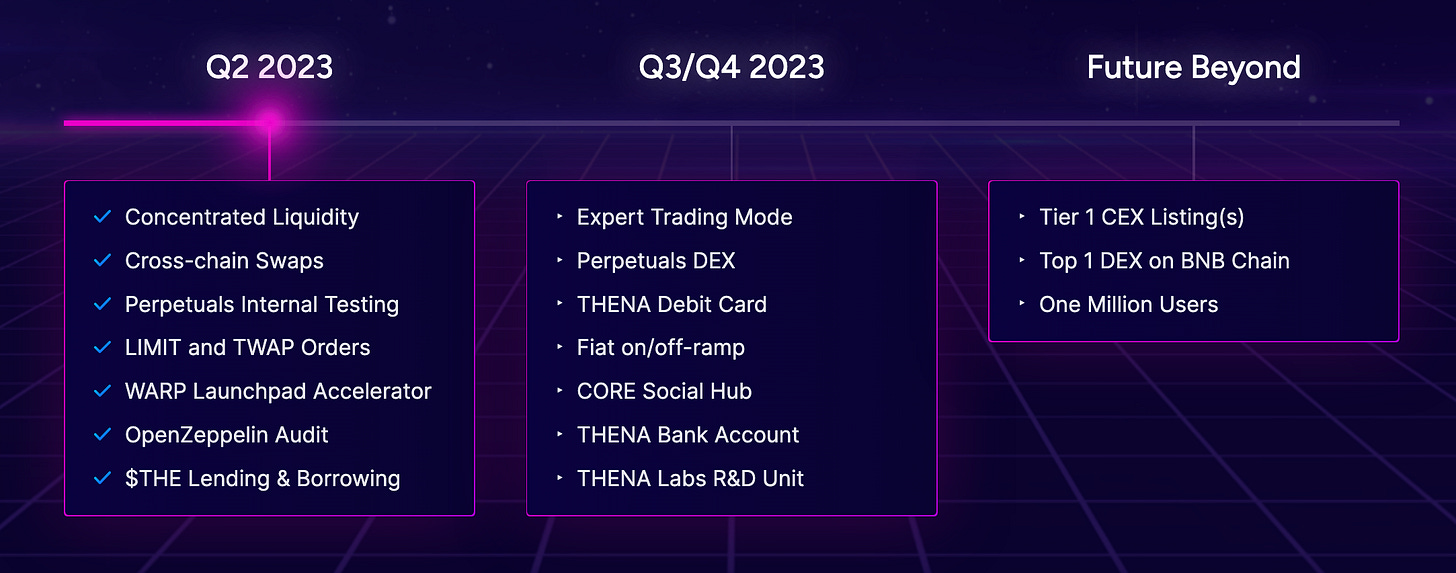

I’ve also developed increasing conviction in Thena, and believe that farming and locking $veTHE has high upside after observing Thena’s go to market execution and monitoring critical metrics since the January launch. On the surface, we see safe and thoroughly audited DEX with a beautiful UI, performant UX, and continuous features being shipped on an ambitious roadmap. The how and why are what intrigues me even more.

Thena’s sustainable Competitive Advantages are:

Team

Thena are a very experienced team of DeFi native builders and professionals who have been around since the 2020 DeFi genesis. They originally followed Andre Cronje’s Solidly DEX launch and metagame that played out on Fantom. Theseus, CEO of Thena, is also the founder of Liquid Driver, a Fantom native yield aggregator.

Aside from believing in the Solidly design and building the ‘liquidity layer’ on Binance Smart Chain, the team are expert partnership builders and business developers. They are a team who know their strengths and weaknesses, and understand when it makes sense to Build versus Buy.

Thus far, they have brought leading DeFi protocols like Frax, Ankr, Radiant, and other leading L1 tokens into the DEX. These tokens are traded with the best execution onchain due to another massively successful partnership with Algebra and Gamma Strategies, who built a comprehensive managed liquidity product for Thena. Thena is one of the most capital efficient DEX in terms of fees generated per TVL.

The team are very dedicated to the long term success of the protocol and they are not selling vested tokens. All of the team’s wallets are tracked on DeFi Wars, and many of them are buying $the or relocking $veTHE for long term yields.

Liquid Driver - $liveTHE is the liquid wrapper around $veTHE. It enables $veTHE holders to receive compounded yield (fees, bribes, rebases) without having to vote on a weekly basis. $liveTHE can also be swapped for liquid $the or other coins on Thena, which means nobody is ever stuck holding their NFT forever. Liquid Driver’s $liveTHE is a cheat code for Thena.

Network Effects

Scaling with Binance for user onboarding

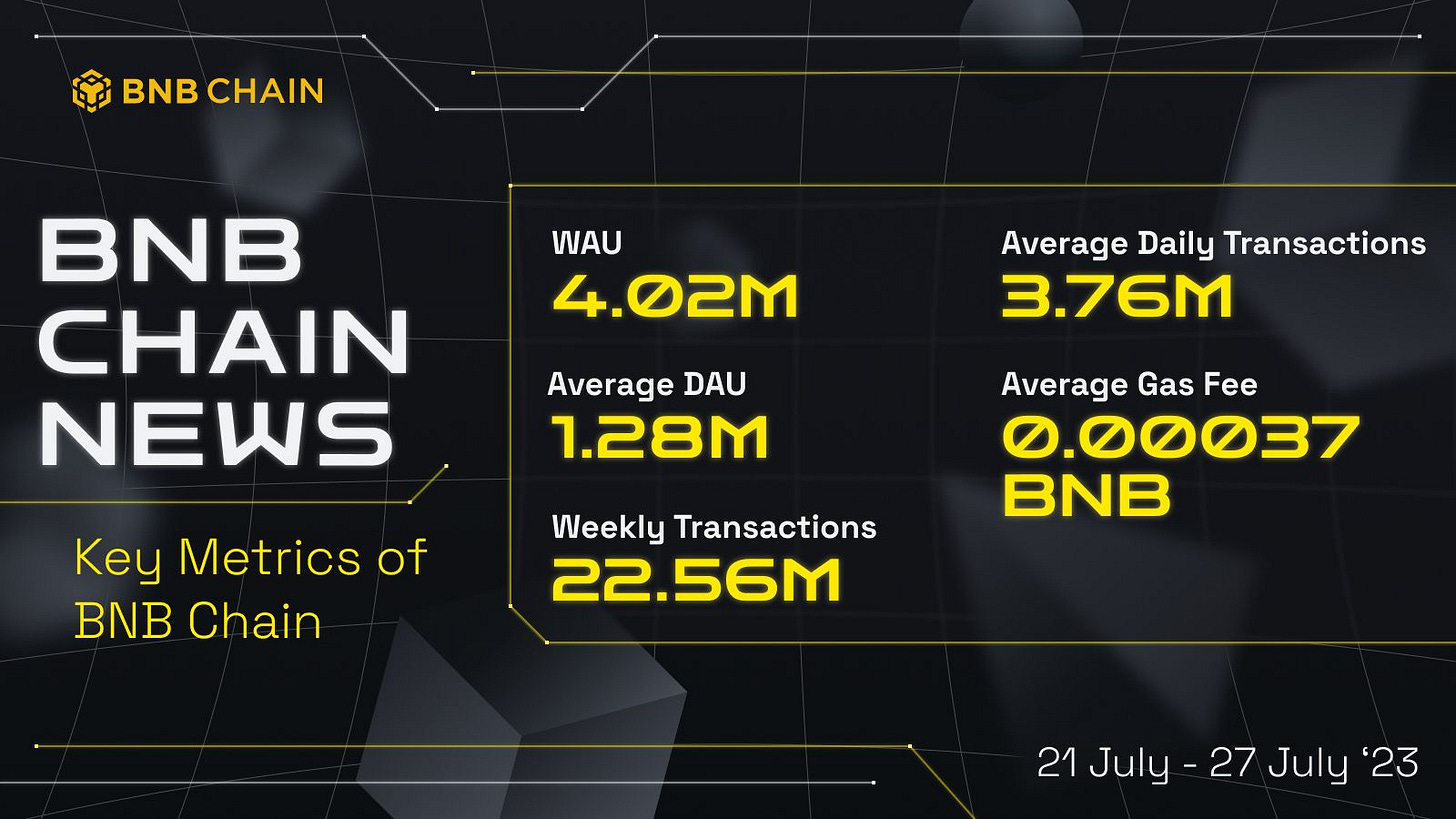

Binance Chain currently has >4m weekly active users and are the top chain, globally, with a particular focus in Asia

Thena will be launching the full protocol stack on opBNB in the near future, which will bring down trading and perps fees by a factor of 4. There have not been any incentives confirmed for BNB Chain’s new optimistic rollup/Layer 2, but Thena would be in a prime position to grab them.

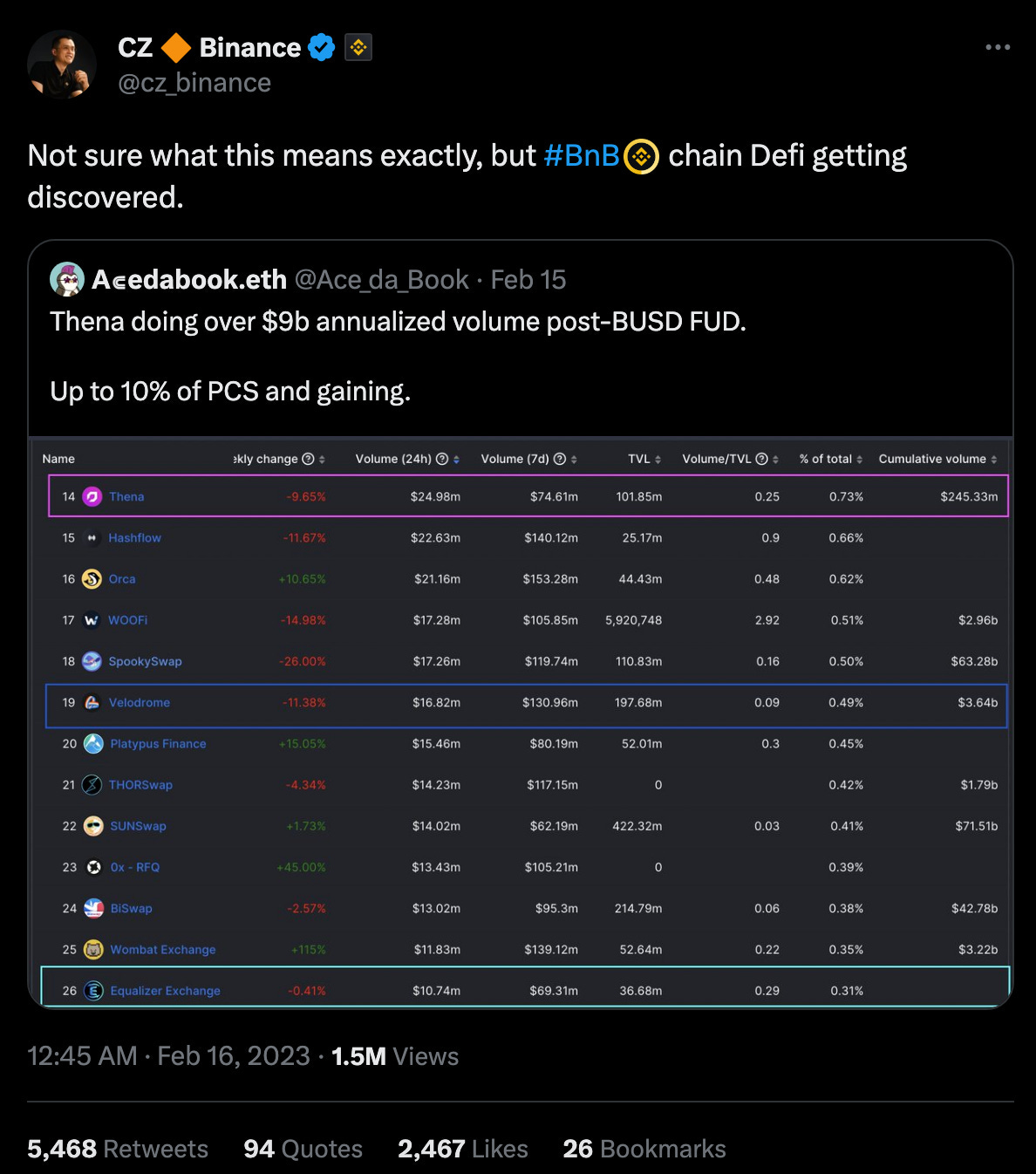

Binance attention - @BNBCHAIN has 3 million followers so clearly there are mutual interests for Thena to be successful. Also, CZ retweeted one of my posts related to Thena, so they are on everybody’s radar.

ALPHA Perps - Another outstanding partnership is with the Symm_io team who have developed the first request for quote mechanism to brings offchain (centralized exchange) liquidity into DeFi for perpetual swap traders to tap into. This new integration will give Thena a tremendous first mover advantage and the ability to dominate open interest for Symm_io. Thena has already discussed taking ALPHA (the Perps protocol) multichain to enable traders to access it without moving funds to Binance Smart Chain.

Over 20% of weekly yield is coming from DEX swap fees, but this should double (at least) once ALPHA perps is out of beta. ALPHA will act like an external gust of wind accelerating the flywheel. ALPHA will dampen price volatility of $the token even more since the flywheel won’t solely depend on the DEX volumes and bribes. All of the perps fees will be funneled in as autobribes to the most productive pools. This mechanism ensures high yields for voters of the most utilized pools, which means more votes and better $the yields for LPs. Liquidity will migrate in as emissions get directed to those pools (think ETH/BNB). Long term, swap fees will be the majority of yield across DeFi so LPs will be forced to lock their tokens in order to earn yield.

Security - Thena is also the most thoroughly audited Solidly code base. Peckshield and OpenZeppelin, arguably two of the most well respected audit firms in blockchain, have both approved Thena’s smart contracts.

Airdrops - $veTHE holders are receiving $veNFTs from every single new Solidly DEX to launch now. DeFi builders understand the importance of converting smart and savvy $veTHE holders into supporters of new Solidly designs. In the past few months, airdrops from Arbitrum, Polygon, zkSync, and Linea have been received by $veTHE holders with many more to come.

Teasers of What’s to Come

CORE - The DeFi social layer built on top of Thena

Thena’s founder, Theseus, envisions traders going to Thena first thing in the morning to get their updates on charts, market sentiment, their positions, and check the scoreboard against the field. Thena will become a hub for onchain perpetuals and DeFi spot trading by enabling the lowest fees on >200 token pairs, allowing influential accounts to share strategies, create copy trading, referrals, and big trading competitions that will be incentivized.

Perps trading will not be incentivized, but Thena plans on spending a lot of money on rewarding the best traders. They have lined up influencers to bring in their followers to trade on ALPHA.

Perps will also enable the creation of an entirely different set of products. Options, hedges, hurdles, etc will all tie together with spot positions in DeFi across a user’s portfolio.

WARP - A high profile project launchpad and liquidity bootstrapping program

New projects would love to partner with the most respected and trusted brand, Thena, on the chain. This gives a new protocol exposure in exchange for a small fee, as well as plenty of capital to seed the project’s development. In addition, the new project can have immediate emissions to their liquidity pool which benefits them by making their protocol owned liquidity productive from day 1.

Thena has teased ThenaX, which many thought was a meme after Twitter rebranded to “X,” but the team confirmed it was not a joke. We can only guess what this is going to be, but the CMO said this in the Discord:

oTokens - Options tokens are becoming popular and we recently had a Twitter Spaces with Magma, Bond Protocol, and Retro about it. oTokens could be carved out of weekly emissions as a way for LPs to get discounted (more) $the if the yield was locked for the maximum amount, two years. This would be extremely beneficial for protocols looking to boost swap fees for their protocol owned liquidity, and as a way to dampen sell pressure on $the.

New chains? Thena has mentioned adding ALPHA perps access through Arbitrum, and recently attended the Mantle Mixer at ethCC, so perhaps during the many glasses of vin, were convinced to deploy on the new Ethereum L2.

My Portfolio Strategy and Final Thoughts

I have been using Thena to DCA into tokens using single sided liquidity, as well as their built in TWAP function. I also have been earning $the when two-sided pools offer attractive yield without significant impermanent loss risk. I then max lock all $the rewards and continuously re-lock to maximize my voting share and weekly yields. The best way to collect high yields is by voting across multiple pools.

I do not plan on selling my entire $veNFT because I have incredibly high conviction Thena is a long term winner, so I will treat the asset like a lifetime annuity by collecting weekly yields. I’ll admit it’s addicting to scoop and lock more $the at this price with all of the bullish items on the roadmap.

My expectation is we will see the development of a better exchange for veNFTs as the emissions are more widely distributed over time, and it will be more difficult to farm and lock $the for $veTHE. This may take the form of a AMM or the like, but in the meantime, Liquid Driver provides an offramp for $veTHE NFTs. I will probably take out my initial investment through splitting my $veNFT and selling through the $liveTHE/$THE pool when we get into the bull market.

In closing, please follow @thenascribe on Twitter for excellent content and use their referral code when trading on Thena https://thena.fi/referral/?ref=thenascribe

Support Ethropy!

Get Grass - Get paid for excess Internet Bandwidth

Canto validator for Four Moons - delegate $CANTO

Ethropy Wallet - ethropy.eth

Buy a Ledger Hardware Wallet (Affiliate Link)

TradingView Referral - Get $30 off annual Subscription

None of this is financial advice