What Happened on Canto since Part I: Canto Investment Thesis

It’s now been seven months since the Canto blockchain’s genesis block. Technically, the chain is running smoothly, and Canto’s bear market growth has been a tremendous success. A marked increase in liquidity, addresses, and transaction/trading volume since the beginning of the year, and especially since the famous “Cantofornia” investment announcement came out from Variant Fund.

The NFT craze, liquidity explosion, memes, and sheer enjoyment resemble the good old days from Ethereum’s DeFi summer. It’s an authentic feeling that’s so needed after 2022’s crypto market blowup thanks to overleveraged funds, predatory VCs, centralized exchange fraud, and opaque lending.

Amongst the noise in crypto, how will Canto maintain growth and what are its competitive advantages?

Growth Strategy - Part II

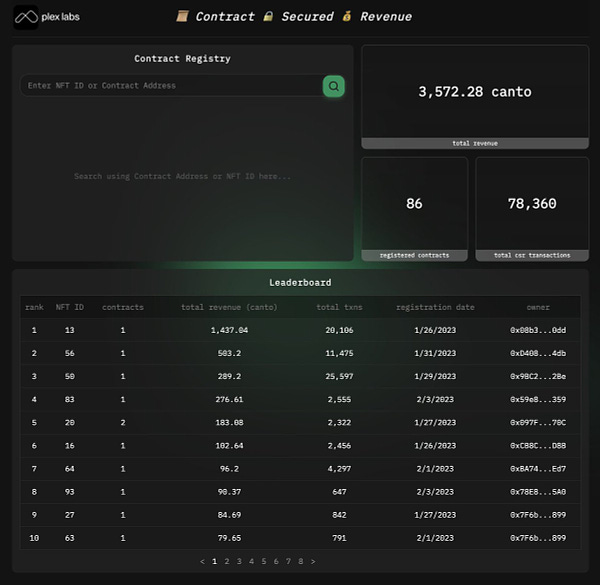

Canto Online Hackathons (COH) began in October and have become an unstoppable marketing engine. Industrious and scrappy builders can avoid the headaches of raising seed money from angels or VCs by showing up with a proof of concept at the COH. They get instant exposure to a well connected, experienced group of influential judges (great marketing), and have the opportunity to win $CANTO prizes to bootstrap further development. These are all broadcast live and hosted brilliantly by Robin Whitney, a contributor, and are a fun way to spend a Sunday. Moreover, traction leads to instant revenues as users interact with the smart contracts and Contract Secured Revenue (CSR) accrues.

Some highlights:

Governance Proposals and Upgrades

Raised minimum number of $CANTO required to propose a new governance initiative

v5.0.0 was released. Includes support for CSR

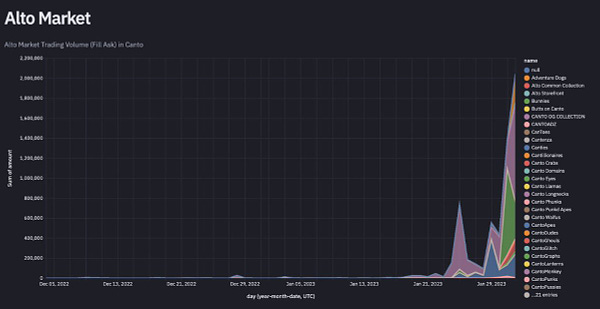

Alto Marketplace explosion! And growing pains, but the team is doing a phenomenal job supporting all of the new collections. Notable projects that minted out are: DeadEnds, Shnoises, Canto Longnecks, Cantographs, Speranza, CanToes, and many more.

Analytics

Neobase Dashboards are amazing. Bookmark them!

Plex’s CSR Dashboard is one to watch too

Canto’s Competitive Advantage - We Learned What’s Important

Free Public Infrastructure and chain level governance are novel and an experiment in progress. While these themes are emphasized as a differentiator from other ecosystems, Canto’s competitive advantage is culture. It’s very unique and can only be compared to the previous bear market/DeFi summer felt on Ethereum. It’s weird, full of die hard web+ believers, and has a DIY attitude. However, it’s friendly and full of unpaid community contributions. What makes a blockchain culture and can you associate economic value to it? Here’s a list of Canto culture differentiators:

Settlers - Early Canto users endured the complexity of using a new blockchain. They helped onboard other new users and evangelized the benefits. Many have staked a claim and become permanent residents by building their own communities, projects, or run a validator.

Creativity - Online hackathons are well attended and teams are very accessible. The recent NFT projects were amazing and had some of the highest trading volume in blockchain.

Memes

The Jazz Chain, The Green Chain, Keep Canto Weird, Based Ghouls, Cantofornia…

What’s Next To Ensure Success

Canto needs sticky liquidity and the chain to remain resilient as builders and users pile in. Chain security looks very strong with 40-50% of the circulating supply currently staked on network validators.

Here’s what to watch:

DeFi

Perps (Yubari Finance), Lending (Blitz Finance), Leveraged Yield Farming (Leverage Finance), No Loss Lottery (Luckanto), Leetswap ($LEET token soon)

0xfoobar is keeping us in suspense with the incentives structure for Forteswap, but quietly rolled out a new UI

NFTs

Alto has many features in the pipeline to improve the marketplace experience

Neons.lol is a NounsDAO fork with an accelerated mint cycle. It should do very well on a chain like Canto with a focus on public goods and organic growth.

CSR Experiments - My favorite so far is CypherSkulls, a PvP game presenting at this season (5) of the COH.

Games - CantoLand, Warped, and many others just check out the COH list

Improved infrastructure

A more readable blockchain explorer (several are in development)

Decentralized Oracle Solution (Nexus Oracles in development)

More RPCs to handle the increased transaction load

NFT Galleries, Curation Platforms (we are launching æra!), NFT aggregators

Liquid staking is actively being developed by the B Harvest team and will improve capital efficiency and increase the percent of supply that are staked to further secure the network. A stCANTO/CANTO pool with incentives will undoubtedly arise somewhere.

Incentives without a token - CSR is the obvious candidate, but bribes have worked very well on other platforms too.

Emissions reductions - Liquidity mining has been a fantastic bootstrapping technique to grow TVL and encourage users to deposit into the DEX/Lending protocols. Over time, emissions will continue to be reduced for sustainable price action. Combined with liquid staking, CSR, and new DApp deployments token price will find an equilibrium that satisfy investors.

IBC - An Osmosis pool has been created for CANTO, but there isn’t any liquidity there. I assume there will be a focus on keeping incentives within the Canto ecosystem, however, other app chains may offer attractive opportunities for liquidity. It would be very cool to see NOTE on the Interchain!

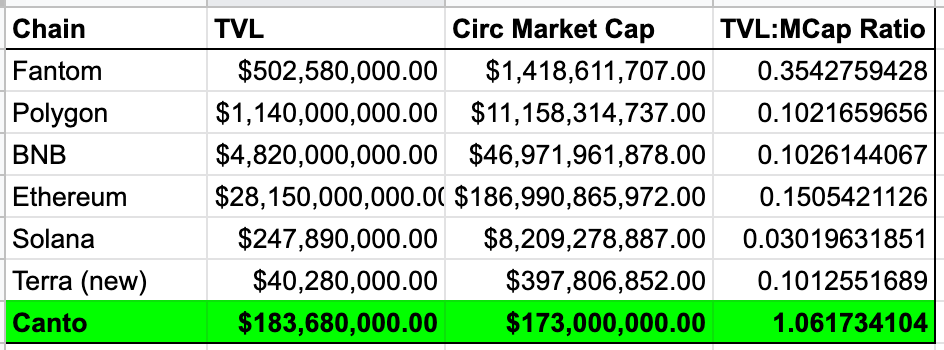

Valuation Analogues

A simple valuation comparing the TVL/Market Cap ratio for other general purpose blockchains shows $Canto is still a value. “CANTO to 5 NOTE” would imply a $2.13b circulating market cap, which isn’t unrealistic in a bull market. TVL would need to be over 10X to maintain the current ratio.

I realize there are many assumptions that went into this comparison, but there is still significant upside.

$CANTO is a long term hold for me that I anticipate will continue to outperform other L1s and Cosmos app chains through the coming months. Canto is focused on building sustainable protocols and free public infrastructure, experimenting with governance, growing from within, and throwing out the rulebook.

Canto Podcasts

Disclaimer:

I hold a position in CANTO and run a Canto validator with the Four Moons team. If you found this article useful, please share and my team welcomes any CANTO staking delegations

Follow the Canto Twitter list.

None of this investment advice.