After a pleasant start to the 2023 crypto market, it feels like we have reached a temporary top. The sentiment around a new bull market seems to be waning with macro headwinds and a lack of new liquidity coming into the crypto space. While many investors are very bearish and front ran the ‘sell in May, walk away’ moniker, my portfolio positioning is to expect a sideways/choppy environment. Bank failures and political pressure (next election) have put the Federal Reserve in a difficult spot to continue rate hikes that battle inflation. Inflation appears to have peaked so the Fed could change course very soon and ease rates to prevent further bank and bond market fallout. The US government debt ceiling will be hit shortly, which means congress will have to approve raising it again in the coming weeks.

Based on the current market participants and macroeconomic situation, I believe we’re in a quiet, neutral spot, which is typical for the year preceding a Bitcoin halving event. I assume $BTC is range bound between $25-30k, $ETH between $1,700-$2,000, and the pattern is likely to continue for several months based on historic bear market bottoms.

Here’s a quick summary of my view on the market and how I’m managing my portfolio.

What happened recently?

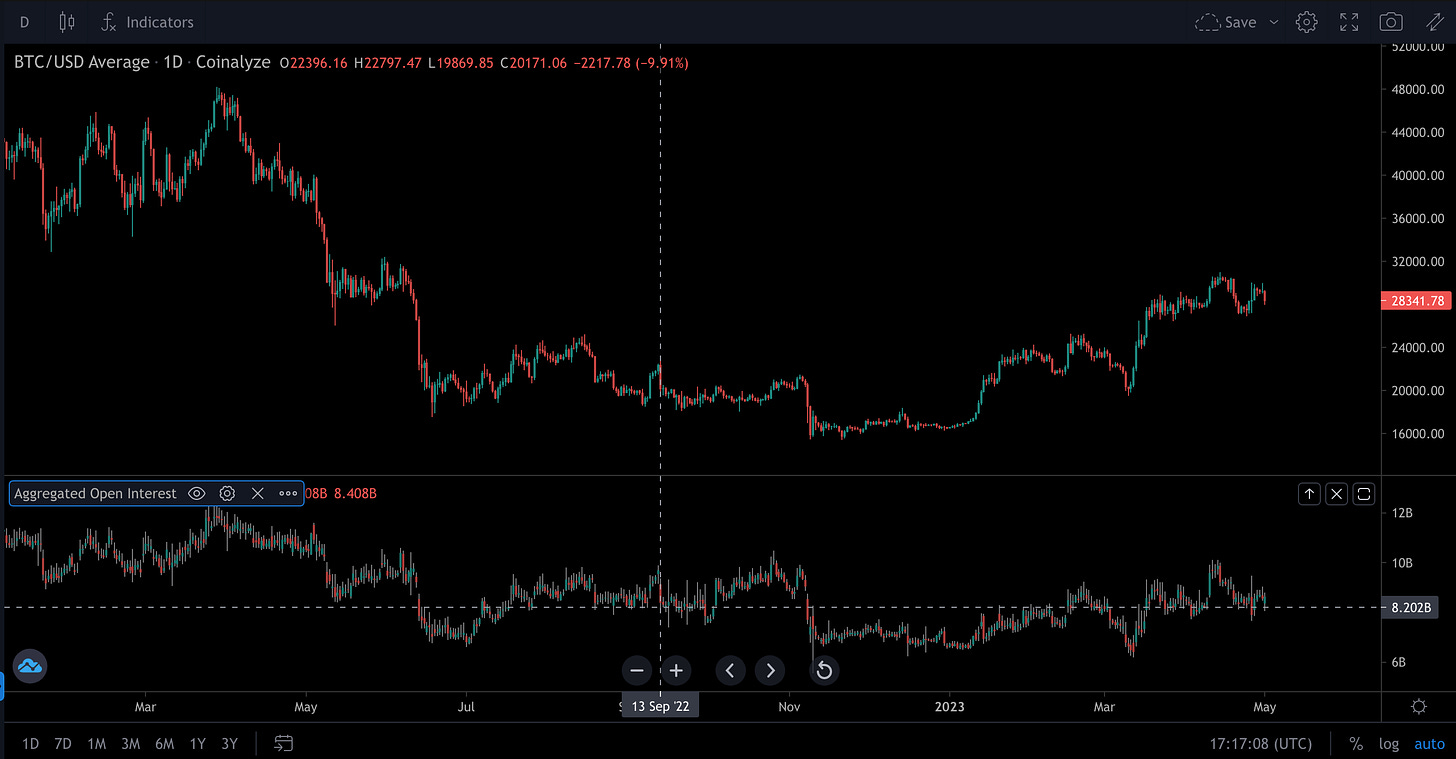

Last week (4/26/23) there was a large wipe out of open interest in the futures markets. Essentially, leverage longs were closed or liquidated during a cascading liquidation event. Open interest is back to the same level as the FTX blowup in Sept, 2022.

Who are the current crypto market participants?

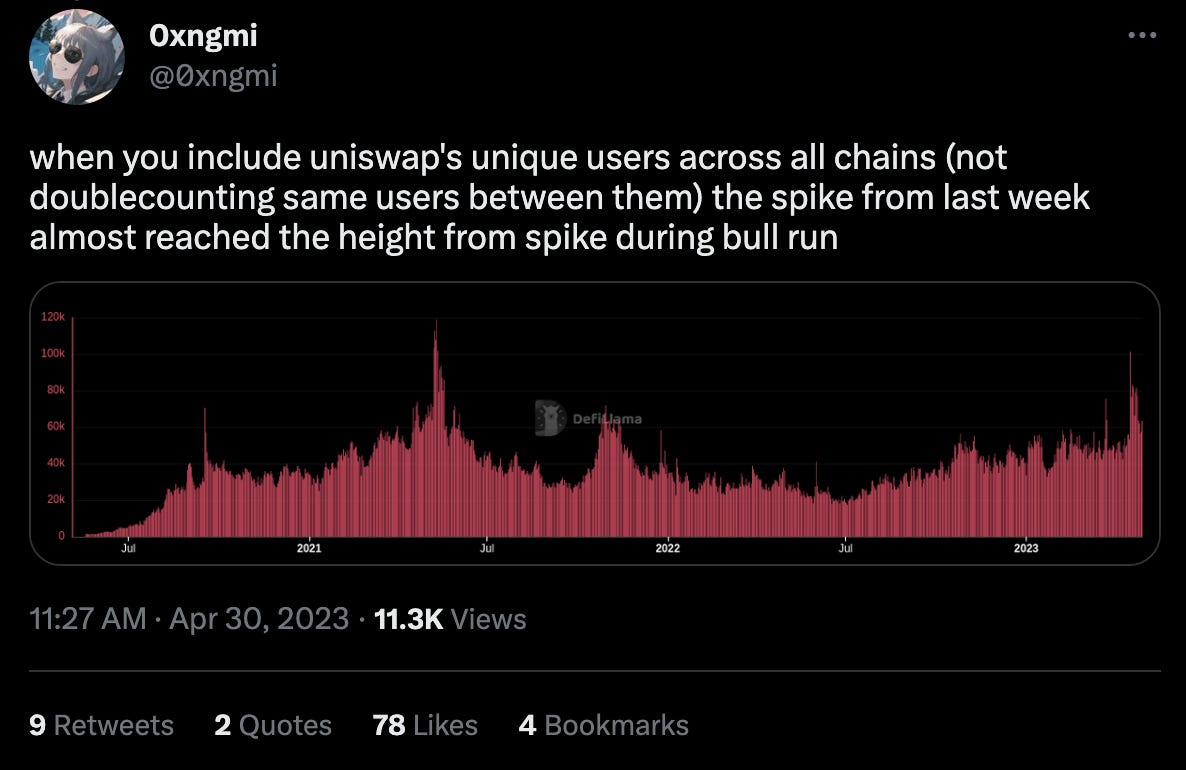

There aren’t many people left. Interestingly, the $PEPE meme coin has onboarded a lot of new DeFi users.

Survivors. 2022 was a brutal bear market with many obvious meltdown catalysts. Rampant inflation, fed tightening, Terra, FTX, centralized lenders, and regulatory crackdown all lead to a furious exit of liquidity from the crypto markets. The only remaining are surviving believers who were smart about self custody and risk management. What are these survivors doing?

Swing traders looking for technical setups

Investors accumulating on the spot market in anticipation of a future bull market

Yield farmers and mercenary capital trying to squeeze blood from a stone

Retail is mostly out of crypto thanks to the 2022 collapse.

New institutional capital is not in due to fears around additional regulatory crackdown and a lack of clarity.

What are the biggest remaining obstacles for crypto?

Regulatory crackdown. The SEC and CFTC continue to duke it out around jurisdictional territory when it comes to crypto. There are also congressional hearings and new legislation being proposed to formalize rules around crypto. Tl;dr we need guidance badly before larger capital enters the space.

Centralized exchanges are still being targeted by global regulators and law force.

What am I’m doing with my PA?

I am focused on four things to keep it simple:

Accumulating spot ETH and other high conviction positions (e.g ARB)

Fundamentally, Ethereum is as strong as its ever been. The combination of EIP-1559 (burning transaction fees) and the completed transition to Proof of Stake will lead to continued deflation on the supply of $ETH.

I believe $ETH will outperform $BTC over the next several years, similarly to historical performance, but even more amplified due to the deflationary mechanisms.

In addition, the emergence of Ethereum scaling via Layer 2s and the coming Eigenlayer only create bigger token sinks for ETH.

Farming and locking my high conviction ve(3,3) DEX tokens to earn weekly yield

I’ve written about how bullish I am on ve(3,3) DEXs multiple times

I continue to pay attention to Thena and Chronos as the top two for the following reasons: top tier teams, largest DeFi ecosystems, BD acumen, and their ability to build and innovate on top of the Solidly model. Thena is building a DeFi platform that includes a DEX with concentrated liquidity (Fusion), and next will be a perpetuals exchange. Chronos have onboarded 30 partners within the Aribtrum and broader ecosystem, adjusted the ve(3,3) tokenomics, introduced maNFTs that provide boosted yield for loyal liquidity providers, and built a tremendous amount of hype around their project.

My strategy is to provide stablecoin and ETH pair liquidity on these DEXes to yield the native asset, lock them for the maximum term, and receive weekly bribes/fees from voting on the platform pools.

Experimenting with LSDFi to earn airdropped tokens and for better capital efficiency on my ETH

As a spot $ETH holder and liquid staker, I always want to be more capital efficient with my tokens. Fortunately, now that withdrawals are enabled from the Proof of Stake chain, there are new protocols emerging that enable easier access to liquid ETH staking. Several of these have teased or stated a future token airdrop.

Swell, Ether.fi, Enlight, Agility, unshETH, OctoLSD, Acid, Asymmetry, Asymmetrix are all playing around with different applications for liquid staked $ETH and deserve a deep dive.

Additional stablecoin protocols backed by staked ETH to watch are Raft and Gravita

Investing in vAMM liquidity pools to earn real yield and tokens

GLP and other vAMM liquidity pools. GLP is an index of low volatility cryptoassets and stablecoins that provides counterparty liquidity for perpetuals traders on GMX. GLP provides rewards in the form of $ETH and $esGMX, and has a relatively low beta to the dollar.

Vela, MUX, Lion are other Arbitrum Perpetuals DEX options building on the GMX model.

Love the new graphic!